Congress Passed Sarbanes-oxley Into Law as a Response to

Congress passed Sarbanes-Oxley into law as a response to. The act implemented new rules for corporations such as setting new auditor standards.

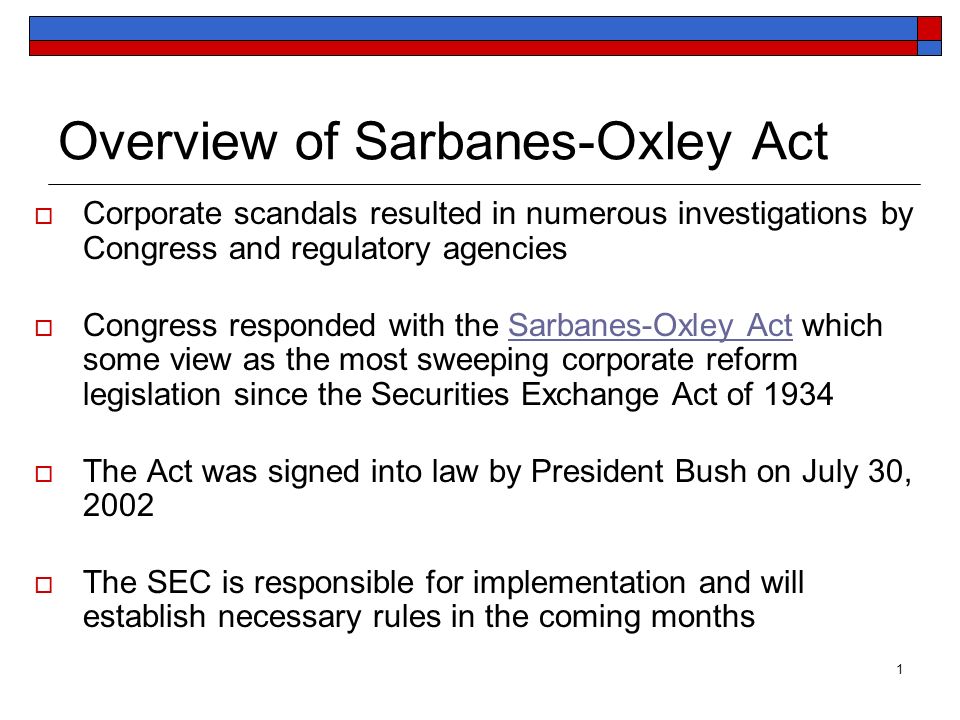

Overview Of Sarbanes Oxley Act Ppt Video Online Download

And 3 inspect investigate and enforce compliance on the part of registered public.

/us-president-george-w--bush-signs-hr-3763-as-membe-51681899-eedd5241d1ca43d5ad2d854242e9a1a7.jpg)

. Congress passed both the Foreign Corrupt Practices Act FCPA or the Act and Sarbanes-Oxley Act SOX in reaction to national corruption and bribery scandals1 The reputation and integrity of American companies were under attack as these scandals unraveled and made international news. In conjunction with SOX exchange listing requirements required firms to have a majority of. While the act has generally been recognized as important and necessary some concerns have been expressed about the cost for small businesses.

In response Congress passed the Sarbanes-Oxley Act of 2002 SOX in an attempt to increase monitoring and improve corporate governance. Congress passed the Sarbanes Oxley Act of 2002 SOX in the hope that SOX would interrupt check and prevent illegal accounting practices by public companies whose activities threatened investors In concert. Congress passed Sarbanes-Oxley into law as a response to.

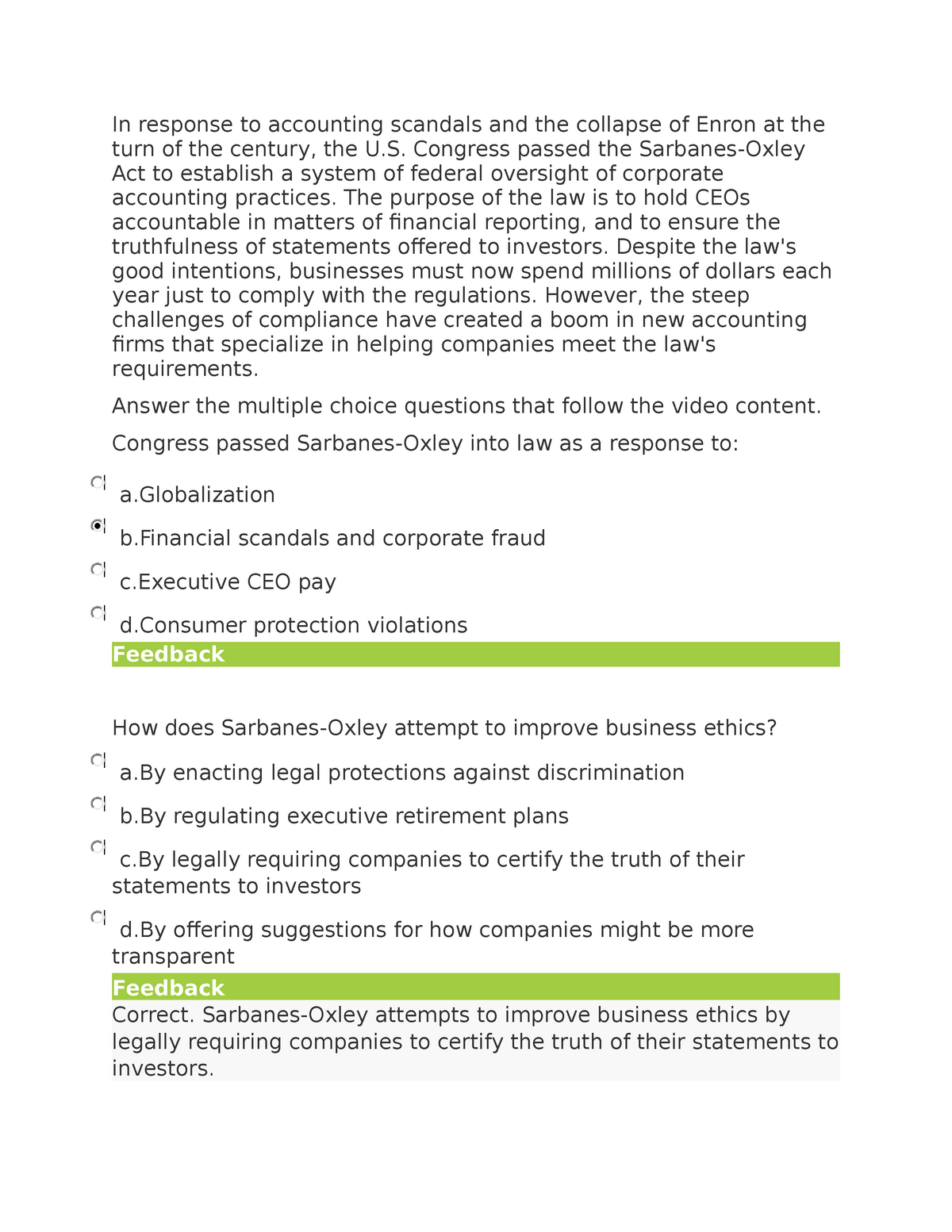

By legally requiring companies to certify the truth of their statements to investors. Law to protect investors by preventing fraudulent accounting and financial practices at publicly traded. Court Weighs Sarbanes-Oxley In the wake of the financial scandal that destroyed Enron Congress created an independent board to watch over the accounting of all publicly traded firms.

The Sarbanes-Oxley Act SOX is a federal act passed in 2002 with bipartisan congressional support to improve auditing and public disclosure in response to several accounting scandals in the early-2000s. In the aftermath of scandals at Enron and other companies Congress four years ago passed the Sarbanes-Oxley Act. A recent speech by SEC Commissioner Allison Herren Lee brought corporate-attorney regulation back into the spotlight.

I voted for the law which made many improvements to corporate governance and accounting. Afinancial scandals and corporate fraud. As a response to several corporate failures resulting from corporate misconduct and fraud Congress passed the Sarbanes-Oxley Act of 2002.

Today I have signed into law HR. The Sarbanes-Oxley Act is an accounting and business related law that was put into place to help boost confidence in financial accounting and financial markets US Sarbanes Oxley Act. Now nearly 20 years after Congress passed the Sarbanes-Oxley Act the congressional mandate to promulgate and enforce rules for corporate attorneys has gone largely unfulfilled.

Then Congress passed the Sarbanes-Oxley Act of 2002 which imposes significant new disclosure and corporate governance requirements for public companies and also provides for substantially increased liability under the federal. It gave law enforcement new tools to fight corporate fraud. It made companies more accountable.

Congress passed the Sarbanes-Oxley Act to help protect investors and restore investor confidence. Public Company Accounting Oversight Board - Establishes the Public Company Accounting Oversight Board Board to. The major stock exchanges adopted new standards to strengthen corporate governance requirements for listed companies.

In response to recently publicized corporate scandals Congress passed the Sarbanes-Oxley Act of 2002 the Act which was signed by the President on July 30 2002. Statement on Signing the Sarbanes-Oxley Act of 2002. The act was named after the bill sponsors Senator Paul Sarbanes and Representative Michael Oxley and is also commonly referred to as SOX.

Allegations of fraud bribery and illegal practices plagued. 3763 An Act to protect investors by improving the accuracy and reliability of corporate disclosures made pursuant to the securities laws and for other purposes The Act adopts tough new provisions to deter and punish corporate and accounting fraud and. 2 establish audit report standards and rules.

Sarbanes-Oxley Act of 2002 - Title I. 1 oversee the audit of public companies that are subject to the securities laws. The Sarbanes-Oxley Act of 2002 was passed by Congress in response to widespread corporate fraud and failures.

The Sarbanes-Oxley Act of 2002 SOX was passed by Congress and signed into law by President Bush to mandate a number of reforms to enhance corporate responsibility enhance financial disclosures and combat corporate and accounting fraud and applies to all public companies in the US large and small The Laws That Govern the Securities Industry 2015. Still regulating attorneys and in. Aby enacting legal protections against discrimination.

78sb shall govern the proposed rules of the Board as fully as if the Board were a registered securities association for purposes of that section 19b except that for purposes of this paragraph. 107204 text 116 Stat. How does Sarbanes-Oxley attempt to improve business ethics.

But all that may change. 4 Proposed rule procedures--The provisions of paragraphs 1 through 3 of section 19b of the Securities Exchange Act of 1934 15 USC. The Sarbanes-Oxley Act sometimes referred to as the SOA Sarbox or SOX is a US.

745 enacted July 30 2002 also known as the Public Company Accounting Reform and Investor Protection Act in the Senate and Corporate and Auditing Accountability Responsibility and. Financial scandals and corporate fraud. While Sarbanes-Oxley is consistently called the broadest-sweeping legislation to affect.

The Act contains sweeping measures dealing with financial reporting conflicts of interest corporate ethics and the oversight of the accounting profession as well as establishing new civil and. OK its been almost a year since President Bush signed the Sarbanes-Oxley Act into law July 30 2002. The SarbanesOxley Act of 2002 is a United States federal law that mandates certain practices in financial record keeping and reporting for corporations.

It strengthened investor protections. Bby regulating executive retirement plans. SOX whistleblower provisions and specifically the application of the law by the courts.

Following the corporate governance scandals of the early 2000s the effectiveness of board monitoring came into question. How does Sarbanes-Oxley attempt to improve business ethics. In this report GAO 1 analyzes the impact of the Sarbanes-Oxley Act on smaller public companies particularly in.

Sarbanes Oxley Video Case In Response To Accounting Scandals And The Collapse Of Enron At The Turn Studocu

0 Response to "Congress Passed Sarbanes-oxley Into Law as a Response to"

Post a Comment